金融機関のCEOに宛てた書簡で, ケニア中央銀行 (CBK) 同国で営業している金融機関は、ナイジェリアの 2 つのフィンテック企業との取引を停止し、中止する必要があると述べています。, フラッターウェーブとチッパーキャッシュ. The letter reiterates the CBK governor Patrick Njoroge and the Asset Recovery Agency (ARA)’s assertions that the two companies are not licensed to operate in Kenya.

コンテンツ

Flutterwave and Chipper’s Clash With the CBK

The Central Bank of Kenya (CBK) has ordered financial institutions in the country to cease and desist from dealing with two Nigerian fintech startups Flutterwave and Chipper Cash. The order came barely 24 hours after the CBK governor, パトリック・ニョロゲ, had 言った journalists that the two entities are not licensed to operate in Kenya.

Before the announcement by the CBK, a High Court in Kenya had ruled that Flutterwave’s bank accounts be frozen to make way for a probe into the fintech giant’s alleged illegal activities. The court ruling subsequently enabled Kenya’s Asset Recovery Agency (ARA) to block Flutterwave’s access to more than 50 bank accounts which reportedly hold nearly $60 100万.

以前のように 報告 Bitcoin-Tidings.com ニュース, the ARA has argued that Flutterwave is not providing merchant services as per claims but is instead involved in money laundering activities. でも, フラッターウェーブ dismissed the allegations and claimed to “have the records to verify this.” The fintech unicorn, どれの 隆起した $250 million earlier this year, also claimed it “maintains the highest regulatory standards in our operations.”

加えて, the fintech firm’s statement claimed its “anti-money laundering practices and operations are regularly audited by one of the Big Four firms.”

CEOs of Financial Institutions Told to Confirm Their Compliance

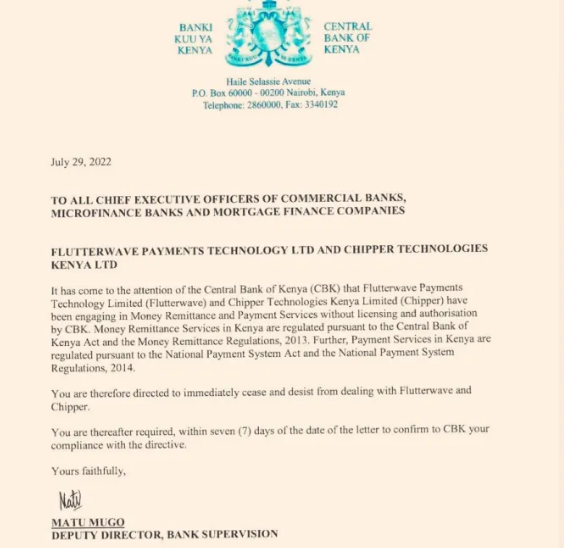

While Flutterwave suggested in its statement that is working with the regulators, Njoroge’s remarks and the CBK’s subsequent letter to CEOs of Kenyan financial institutions dated July 29, reiterate ARA’s allegations that Flutterwave is engaged in “money remittance and payment services without licensing and authorization.”

その間, in addition to informing the heads of the Kenyan financial institutions about the two fintechs’ operating license status, the letter also demands the CEOs to confirm their compliance with the order within seven days.

“You are therefore directed to immediately cease and desist from dealing with Flutterwave and Chipper. You are thereafter required, within seven days of the date of the letter to confirm to CBK your compliance with the directive,” the CBK’s letter reads.

Register your email here to get a weekly update on African news sent to your inbox:

この話についてどう思いますか? 以下のコメントセクションであなたの考えを教えてください.

画像クレジット: シャッターストック, Pixabay, ウィキ・コモンズ

免責事項: この記事は情報提供のみを目的としています. 売買の申し出の直接的な申し出または勧誘ではありません, または製品の推奨または保証, サービス, または企業. Bitcoin-Tidings.com 投資を提供しない, 税, 法的, または会計アドバイス. 会社も著者も責任を負いません, 直接的または間接的に, コンテンツの使用または依存によって、またはそれに関連して引き起こされた、または引き起こされたと主張されている損害または損失について, この記事で言及されている商品またはサービス.

読んだ 免責事項