Charles Schwab’s $655 billion asset management arm is launching its first crypto-related exchange-traded fund (fondo cotizado en bolsa). The new fund is expected to start trading this week on the NYSE Arca exchange.

Contenido

Charles Schwab Launches Its First Crypto-Related ETF

Schwab Asset Management, a subsidiary of The Charles Schwab Corp., announced last week the launch of the Schwab Crypto Thematic ETF (NYSE Arca: STCE), calling the new product “its first crypto-related ETF.”

Charles Schwab is a major American brokerage, banking, and financial services company. Schwab Asset Management currently has over $655 billion in assets under management, according to its website. It is the third largest provider of index mutual funds and the fifth largest provider of exchange-traded funds (ETFs).

The first day of trading for the Schwab Crypto Thematic ETF is expected to be on or about Aug. 4, los detalles del anuncio, agregando:

The fund is designed to track Schwab Asset Management’s new proprietary index, the Schwab Crypto Thematic Index.

According to the fund’s prospectus filed with the U.S. Comisión Nacional del Mercado de Valores (SEGUNDO) Viernes, the Schwab Crypto Thematic ETF is “designed to deliver global exposure to companies that may benefit from the development or utilization of cryptocurrencies (including bitcoin) and other digital assets, and the business activities connected to blockchain and other distributed ledger technology.” Furthermore, “The fund is non-diversified, which means that it may invest in the securities of relatively few issuers,” the company warned.

The announcement notes:

The fund will not invest in any cryptocurrency or digital assets directly. It invests in companies listed in the Schwab Crypto Thematic Index.

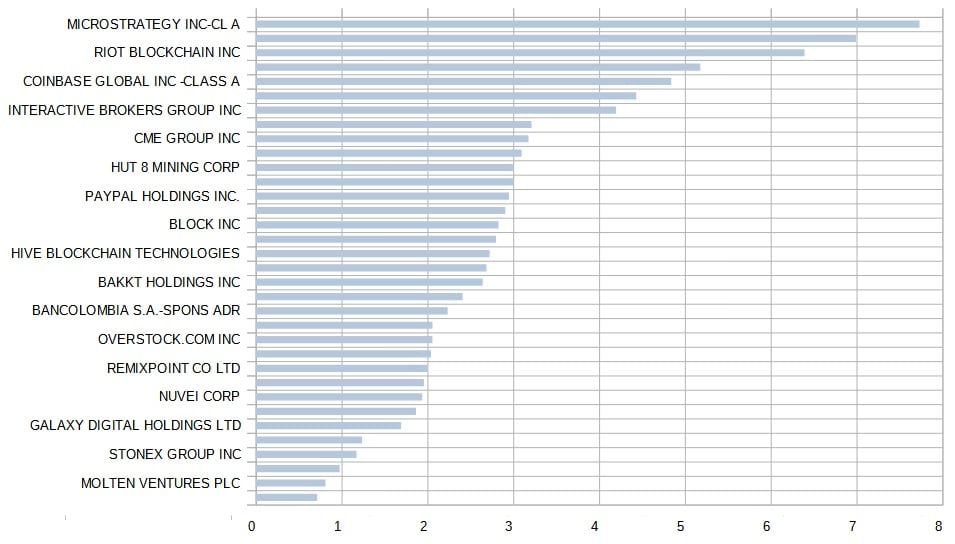

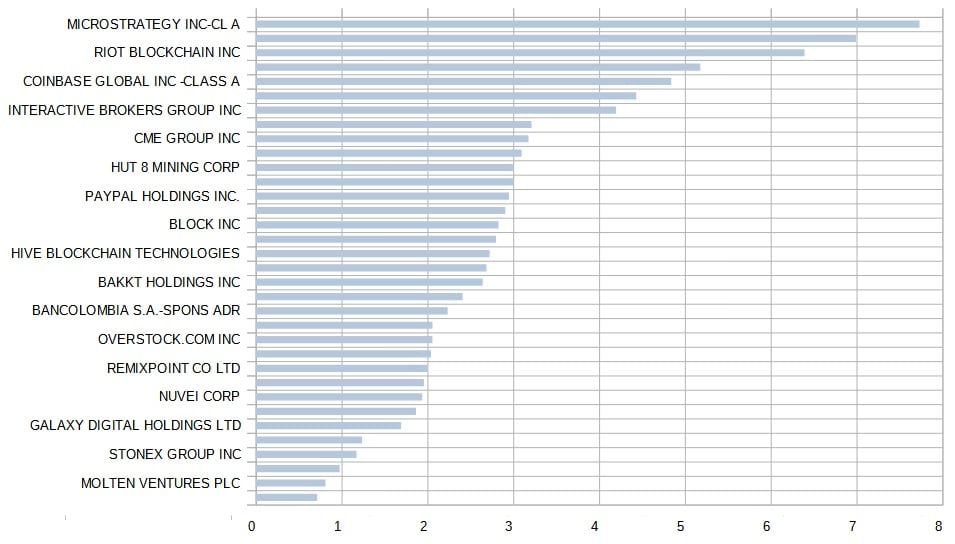

The Schwab Crypto Thematic Index’s constituents as of July 29 include Microstrategy, Participaciones digitales de maratón, Riot Blockchain, Silvergate Capital, Coinbase Global, Robinhood Markets, Interactive Brokers, Nvidia, CME Group, Bitfarms, Hut 8 Minería, International Exchange, PayPal, SBI Holdings, Block Inc., Monex Group, Hive Blockchain, Internet Initiative Japan, Bakkt Holdings, NCR Corp., and Bancolombia.

David Botset, managing director and head of Equity Product Management and Innovation at Schwab Asset Management, comentado:

The Schwab Crypto Thematic ETF seeks to provide access to the growing global crypto ecosystem along with the benefits of transparency and low cost that investors and advisors expect from Schwab ETFs.

Mientras tanto, the SEC still has not approved a bitcoin spot ETF despite approving several bitcoin-futures ETFs. In June, Grayscale Investments, the world’s largest digital asset manager, filed a lawsuit against the SEC after the securities regulator rejected its application to convert its flagship bitcoin trust, GBTC, into a spot bitcoin ETF.

What do you think about Schwab Asset Management launching its first crypto-related ETF? Háganos saber en la sección de comentarios.

Créditos de imagen: Shutterstock, pixabay, Wiki Commons

Descargo de responsabilidad: Este artículo es solo para fines informativos.. No es una oferta directa o solicitud de una oferta para comprar o vender, o una recomendación o respaldo de cualquier producto, servicios, o empresas. Bitcoin-Tidings.com no proporciona inversión, impuesto, legal, o asesoramiento contable. Ni la empresa ni el autor son responsables, directa o indirectamente, por cualquier daño o pérdida causado o presuntamente causado por o en relación con el uso o la confianza en cualquier contenido, bienes o servicios mencionados en este artículo.

Leer Descargo de responsabilidad