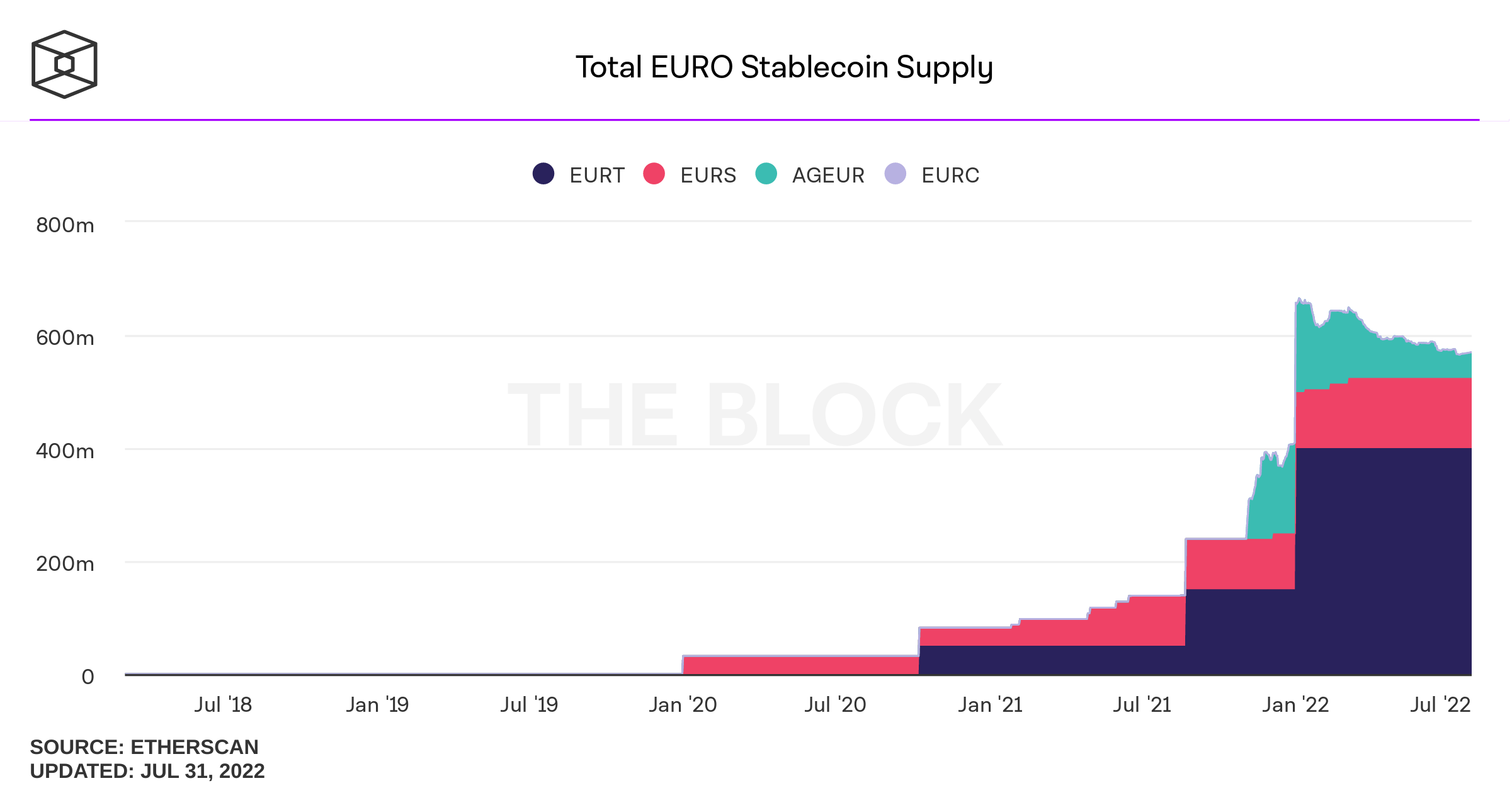

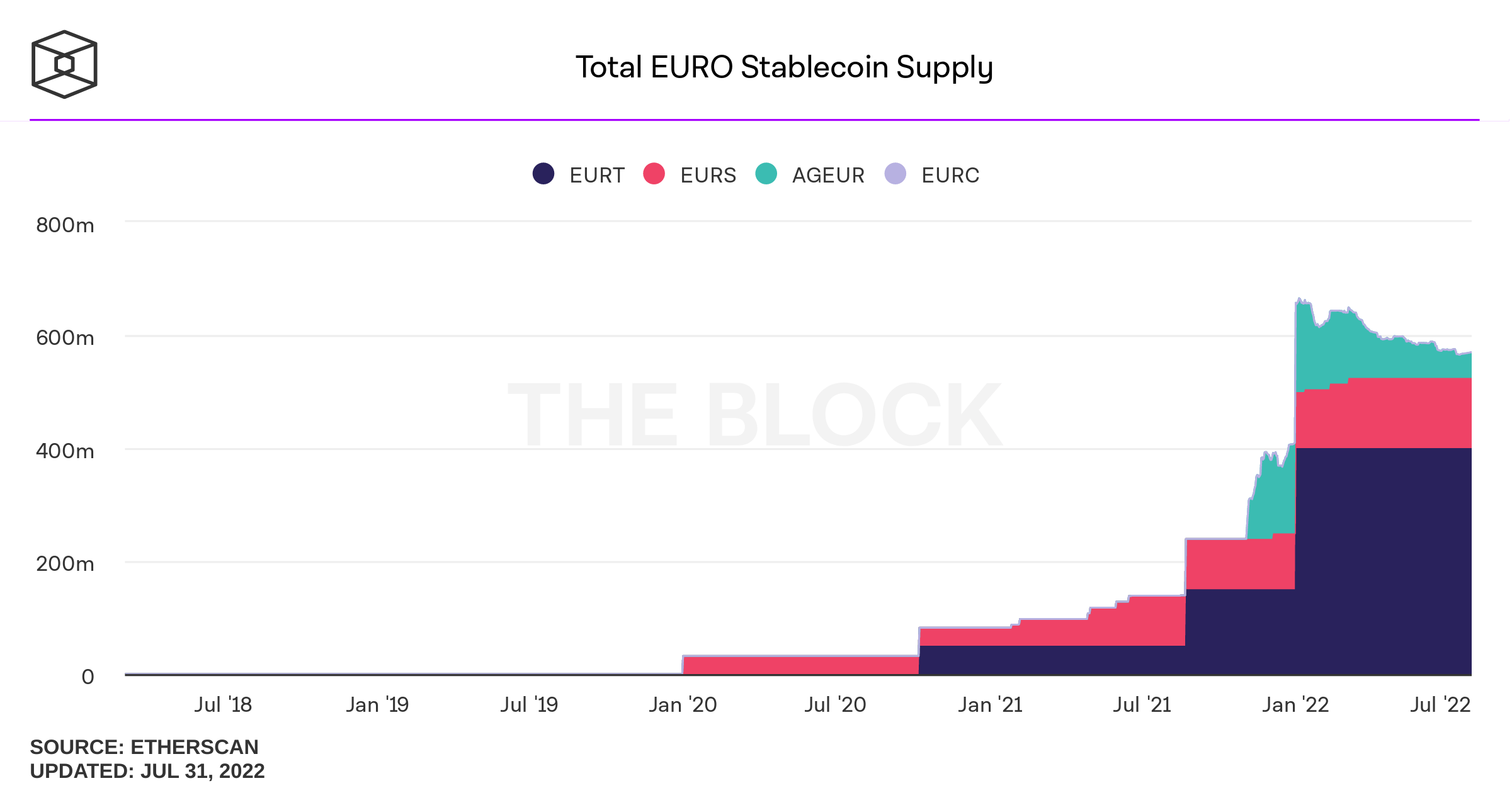

Während die Stablecoin-Wirtschaft ungefähr wert ist $153 Milliarden heute, Die Ausgabe von Euro-unterstützten Stablecoins hat zugenommen 1,683% von $31.9 Euro-basierte Token im Wert von einer Million Euro im Januar 3, 2020, to today’s $569 Million. Seit November 2021, the number of euro stablecoins swelled by 85.34%, but from January 2022 bis heute, euro stablecoin numbers dropped 14.17% during the last seven months.

Inhalt

Euro-Pegged Stablecoins Cross Half a Billion in Value Since the Start of the Year

Heute, most of the stablecoin economy’s value is based on tokens backed by the U.S. Dollar, but a small number of other crypto-fiat tokens exist as well. Zum Beispiel, while the stablecoin issuer Halteseil manages the largest USD-pegged token USDT, Tether also manages fiat-pegged crypto assets based on the euro, Gewicht, Pfund Sterling, and yuan.

Tether recently launched British pound sterling und Mexican peso Stallmünzen, and the stablecoin issuer Kreis just gestartet the company’s second major stablecoin backed 1:1 with the euro. According to data, there’s more than a half-billion worth of euro-based stablecoins in existence today, oder approximately $569 Million im Juli 31, 2022.

The value of the euro-based stablecoin economy has swelled by 1,683% since the first month of 2020. Tether’s euro-pegged stablecoin is the largest of them all, mit $400 million worth of EURT in circulation today. Stasis euro (EUR) issued by Stase is the second-largest euro stablecoin with a $124 million market cap, und Angle Protocol’s Alter (ALTER) verfügt über $44.34 million worth of AGEUR in circulation.

While Circle has introduced the euro-pegged stablecoin Euro-Münze (EUROC), the market valuation is much lower than the top euro stablecoin contenders. There’s approximately 1,020,192 EUROC in circulation today after the company first issued 2,330 EUROC on June 30. Even though Circle’s euro-pegged crypto has a low market cap compared to EURT, EUR, and AGEUR, since June 30 EUROC’s overall valuation grew by 43,685%.

The Aggregate Euro Stablecoin Valuation Is a Drop in the Ocean Compared to USD-Pegged Stablecoins

Stasis euro (EUR) increased 799.42% since June 5, 2020, but AGEUR’s market valuation did the opposite, dropping 74.94% von 177 million AGEUR to today’s $44.34 million worth of AGEUR. Tether’s EURT and Angle Protocol’s AGEUR have roughly the same amount of 24-hour trade volume, as EURT has seen $1,451,459 in 24-hour trades and AGEUR recorded $1,492,259 in global swaps.

Stasis euro has seen the most trade volume on August 1, 2022, mit $13,273,109 in global trades, and Circle’s EUROC has recorded just over $127K in 24-hour trade volume. The number of euro-based stablecoins has increased a great deal since 2020 but since the first month of 2022, the quantity of euro-based stablecoins has declined by 14.17%. There are also a few smaller euro-based stablecoin crypto projects like EURST und EUROS.

Darüber hinaus, despite the 1,683% increase over the last two years, euro-pegged stablecoins are just a drop in the ocean compared to the entire stablecoin economy. Euro crypto assets today only represent 0.37% des $153 billion stablecoin economy. Außerdem, while the number of euro-pegged stablecoins has increased since 2020, the euro’s value against the U.S. Dollar has been shaky. In mid-July, the euro met parity with the U.S. dollar but since then it has jumped above it again at $1.02 per euro Im August 1.

What do you think about the growth of euro crypto tokens in the stablecoin economy? Teilen Sie uns Ihre Meinung zu diesem Thema in den Kommentaren unten mit..

Bildnachweise: Shutterstock, Pixabay, Wiki-Commons, theblock.co/data/decentralized-finance/stablecoins/total-euro-stablecoin-supply

Haftungsausschluss: Dieser Artikel dient nur zu Informationszwecken. Es ist kein direktes Angebot oder Aufforderung zur Abgabe eines Angebots zum Kauf oder Verkauf, oder eine Empfehlung oder Befürwortung von Produkten, Dienstleistungen, oder Firmen. Bitcoin-Tidings.com bietet keine Investition, MwSt, legal, oder Buchhaltungsberatung. Weder das Unternehmen noch der Autor sind dafür verantwortlich, direkt oder indirekt, für alle Schäden oder Verluste, die durch oder in Verbindung mit der Nutzung oder dem Vertrauen auf Inhalte verursacht oder angeblich verursacht wurden, Waren oder Dienstleistungen, die in diesem Artikel erwähnt werden.

Lesen Haftungsausschluss