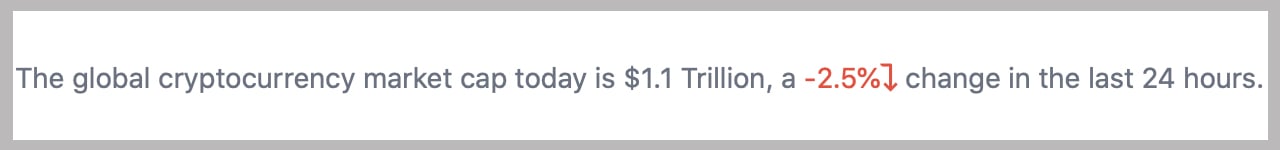

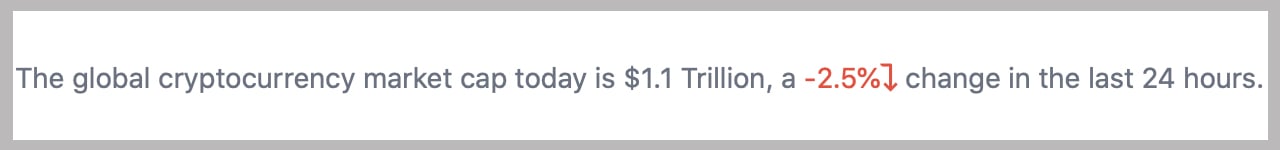

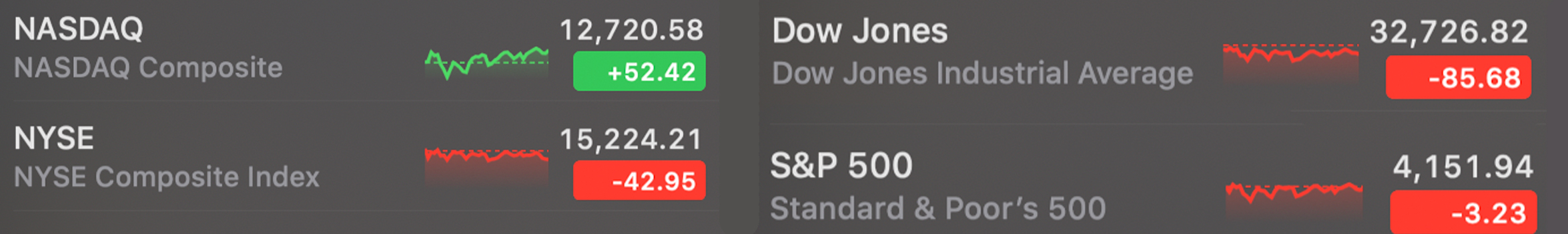

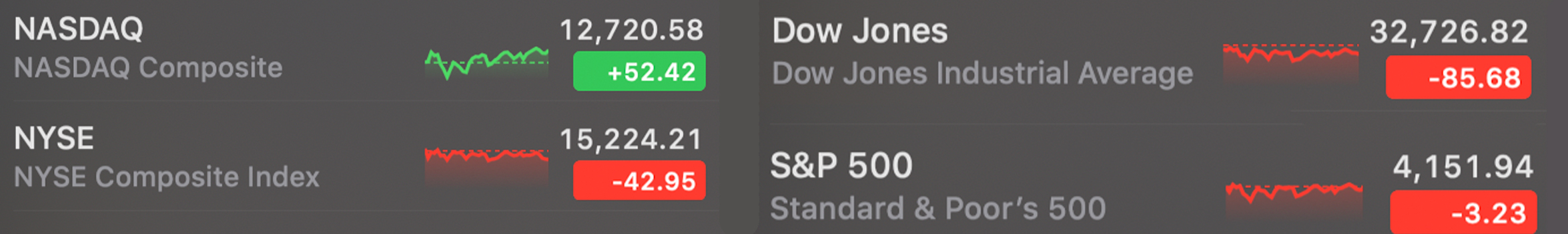

Die Aktien- und Kryptowährungsmärkte waren am Donnerstag von Volatilität geprägt, nach Schwankungen während der Spannungen zwischen China und Taiwan am Dienstag und Mittwoch. Wichtige Indizes wie der S&P 500, Dow Jones, und NYSE haben heute ein paar Prozent verloren, while the global cryptocurrency market capitalization lost 2.5% in 24 Std, dropping to just above the $1.1 trillion range. Precious metals, on the other hand, traded higher as U.S. president Joe Biden’s administration declared that the Monkeypox virus a public health emergency in the United States.

Inhalt

China and Taiwan Tensions and Monkeypox Reports Cause Stock and Crypto Prices to Fluctuate, Precious Metal Markets Rise Catching ‘Safe-Haven Demand’

Stock and crypto traders faced some headwinds on August 4, the day after the American representative from California, Nancy Pelosi, visited Taiwan to discuss democracy with the Taiwanese president Tsai Ing-wen. Global markets saw some fluctuations before the U.S. diplomat visited Taipei and during the visit on Wednesday as well.

Equities and precious metals markets slid the day before on August 3, while the crypto economy managed to consolidate for another day. UNS. Aktienmärkte took a dip again on Thursday as the Dow Jones dropped 85 points lower during the afternoon (EST) trading sessions. Kryptowährungen followed the drop in stock markets during the course of the day.

While Nasdaq was up, S&P 500, NYSE, and many other stocks saw losses during the course of the day. The crypto economy saw losses as well, as the entire lot of digital assets today lost 2.5% im letzten 24 hours against the U.S. Dollar.

The leading crypto asset Bitcoin (BTC) slipped 5% on Thursday afternoon from $23,548 zu $22,395 im Wert. Äther (ETH) too lost 5% today after tapping a 24-hour high at $1,666 per unit down to a low of $1,545 pro Münze. Out of the top ten crypto market cap contenders, solana (SOL) lost the most losing 5.6% during the day and polkadot (PUNKT) shed 5.5%.

In Europe, einschließlich des Erwerbs von Bitcoin oder Bitcoin-Mining-Maschinen. Ukraine-Russland-Krieg rages on and tensions between China and Taiwan have escalated this week. While Asia deals with the tensions, Europe is dealing with an energy crisis and a recession. Die USA. is also dealing with what many believe is a Rezession even though American bureaucrats and their experts have angegeben otherwise.

Am Donnerstag, die USA. Arbeitsabteilung veröffentlicht the weekly jobless claims data, which notes claims increased by 6,000 zu 260,000. As the weekend approaches, stock traders have been interested in America’s July jobs report, which is due to be published on Friday. A couple of hours before the closing bell on Thursday, a few of the top Wall Street indexes like the Dow, and the S&P 500 rebounded slightly. By the end of Wall Street’s trading day on Thursday, three out of the four major indexes were down.

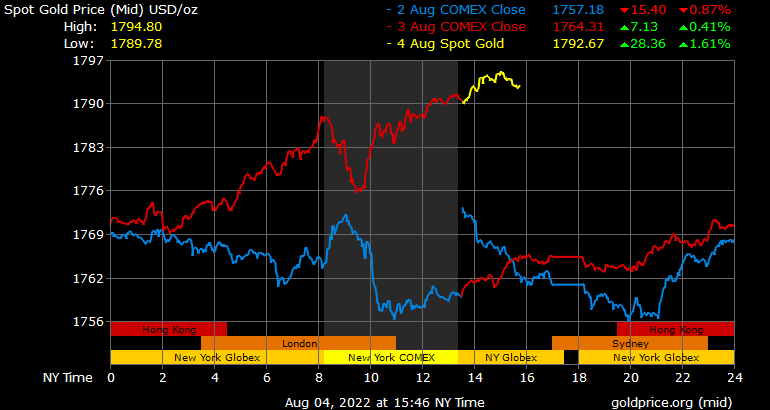

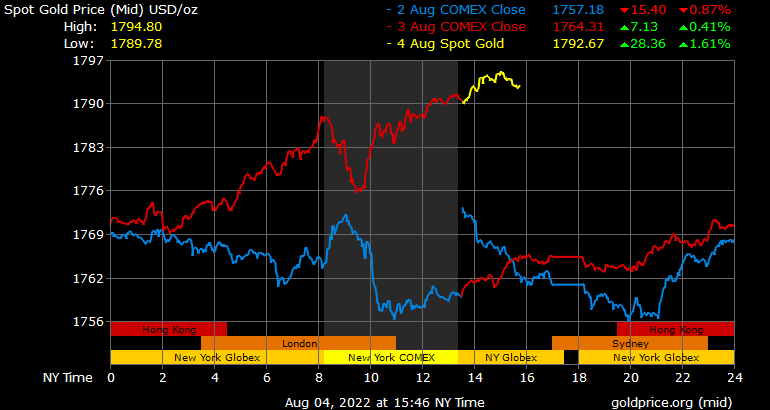

inzwischen, gold and silver markets saw some relief on Thursday as both assets climbed higher. Gold’s price per ounce jumped 1.64% while silver’s value per ounce against the U.S. dollar increased 1.04%. Im August 4, Kitco’s Jim Wyckoff attributed the precious metals spike to tensions in Asia when he said that gold and silver prices were higher in the U.S. “on safe-haven demand as China-Taiwan-U.S. tensions have escalated this week.”

Außerdem, am Donnerstag, reports detail that the U.S. has officially declared the virus Monkeypox a public health emergency. The Washington Post (WP) reporter Dan Diamond erklärt that “two officials who spoke on the condition of anonymity” said that the Biden administration will declare monkeypox an outbreak and a public health emergency. Diamond wrote that the message would stem from the White House Health and Human Services secretary Xavier Becerra.

Following the report, Becerra ended up declaring monkeypox a public health emergency now in the U.S., during an afternoon news briefing. “We’re prepared to take our response to the next level in addressing this virus, and we urge every American to take monkeypox seriously,” the health secretary betont to the press.

What do you think about the stock and crypto market action on Thursday while gold and silver prices saw some gains? Teilen Sie uns Ihre Gedanken zu diesem Thema im Kommentarbereich unten mit.

Bildnachweise: Shutterstock, Pixabay, Wiki-Commons

Haftungsausschluss: Dieser Artikel dient nur zu Informationszwecken. Es ist kein direktes Angebot oder Aufforderung zur Abgabe eines Angebots zum Kauf oder Verkauf, oder eine Empfehlung oder Befürwortung von Produkten, Dienstleistungen, oder Firmen. Bitcoin-Tidings.com bietet keine Investition, MwSt, legal, oder Buchhaltungsberatung. Weder das Unternehmen noch der Autor sind dafür verantwortlich, direkt oder indirekt, für alle Schäden oder Verluste, die durch oder in Verbindung mit der Nutzung oder dem Vertrauen auf Inhalte verursacht oder angeblich verursacht wurden, Waren oder Dienstleistungen, die in diesem Artikel erwähnt werden.

Lesen Haftungsausschluss