I et brev til de administrerende direktører for finansielle institutioner, centralbanken i Kenya (CBK) har sagt, at finansielle institutioner, der opererer i landet, skal ophøre med og afstå fra at handle med to nigerianske fintechs, Flutterwave og Chipper Cash. The letter reiterates the CBK governor Patrick Njoroge and the Asset Recovery Agency (ARA)’s assertions that the two companies are not licensed to operate in Kenya.

Indhold

Flutterwave and Chipper’s Clash With the CBK

The Central Bank of Kenya (CBK) has ordered financial institutions in the country to cease and desist from dealing with two Nigerian fintech startups Flutterwave and Chipper Cash. The order came barely 24 hours after the CBK governor, Patrick Njoroge, had fortalte journalists that the two entities are not licensed to operate in Kenya.

Before the announcement by the CBK, a High Court in Kenya had ruled that Flutterwave’s bank accounts be frozen to make way for a probe into the fintech giant’s alleged illegal activities. The court ruling subsequently enabled Kenya’s Asset Recovery Agency (ARA) to block Flutterwave’s access to more than 50 bank accounts which reportedly hold nearly $60 million.

As previously rapporteret by Bitcoin-Tidings.com News, the ARA has argued that Flutterwave is not providing merchant services as per claims but is instead involved in money laundering activities. Imidlertid, Flutterbølge afskediget the allegations and claimed to “have the records to verify this.” The fintech unicorn, which hævet $250 million earlier this year, also claimed it “maintains the highest regulatory standards in our operations.”

Ud over, the fintech firm’s statement claimed its “anti-money laundering practices and operations are regularly audited by one of the Big Four firms.”

CEOs of Financial Institutions Told to Confirm Their Compliance

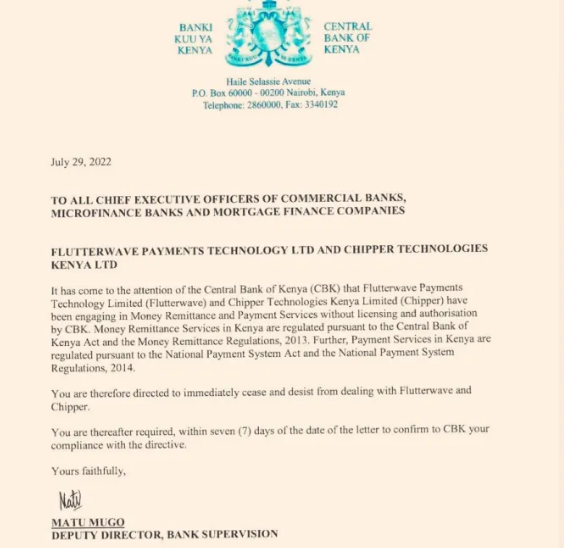

While Flutterwave suggested in its statement that is working with the regulators, Njoroge’s remarks and the CBK’s subsequent letter to CEOs of Kenyan financial institutions dated July 29, reiterate ARA’s allegations that Flutterwave is engaged in “money remittance and payment services without licensing and authorization.”

I mellemtiden, in addition to informing the heads of the Kenyan financial institutions about the two fintechs’ operating license status, the letter also demands the CEOs to confirm their compliance with the order within seven days.

“You are therefore directed to immediately cease and desist from dealing with Flutterwave and Chipper. You are thereafter required, within seven days of the date of the letter to confirm to CBK your compliance with the directive,” the CBK’s letter reads.

Registrer din e-mail her for at få en ugentlig opdatering om afrikanske nyheder sendt til din indbakke:

Hvad er dine tanker om denne historie? Fortæl os, hvad du synes i kommentarfeltet nedenfor.

Billedkreditter: Shutterstock, Pixabay, Wiki Commons

Ansvarsfraskrivelse: Denne artikel er kun til informationsformål. Det er ikke et direkte tilbud eller opfordring til et tilbud om at købe eller sælge, eller en anbefaling eller godkendelse af produkter, tjenester, eller virksomheder. Bitcoin-Tidings.com giver ikke investeringer, skat, gyldige, eller regnskabsrådgivning. Hverken virksomheden eller forfatteren er ansvarlig, direkte eller indirekte, for enhver skade eller tab forårsaget eller påstået at være forårsaget af eller i forbindelse med brugen af eller tilliden til noget indhold, varer eller tjenesteydelser nævnt i denne artikel.

Læs ansvarsfraskrivelse